Challenges

- Company book identified only 2.5% bad lease – payment history data was fraught with inconsistent figures

- After incorporating liquidation/insolvency/dissolution status and rating from credit bureau record, the incidence was boosted to 12%. The process classified non takers of loan to Good and Bad by a logical method and not by reject inference

Solution

- Model developed by R program

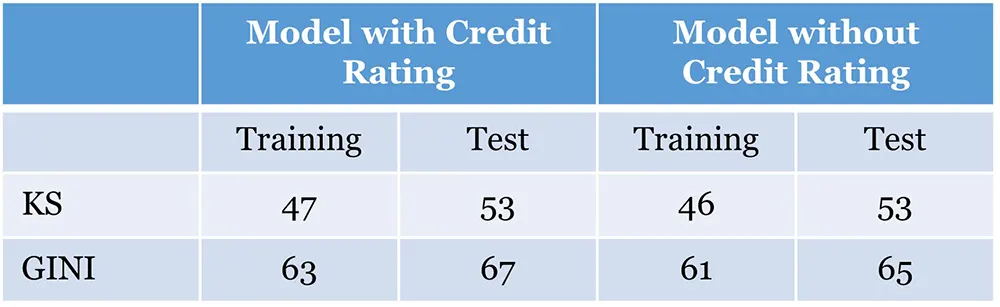

- 2 scorecards with and without credit bureau ratings were delivered

- Discriminatory power of the scorecards were high as seen from high KS and GINI