Solution

The whole process is automated with Smart proprietary software, ACreS

4 portfolios were built one each for Retail SME, Corporate SME, Retail Vehicle Loan and Corporate Vehicle Loan.

In absence of core banking system, webservice is created to input data and receive instant score

Newly entered data is stored in a database

Benefits

Process automation, ensured consistency, decreased manual work and increased accuracy.

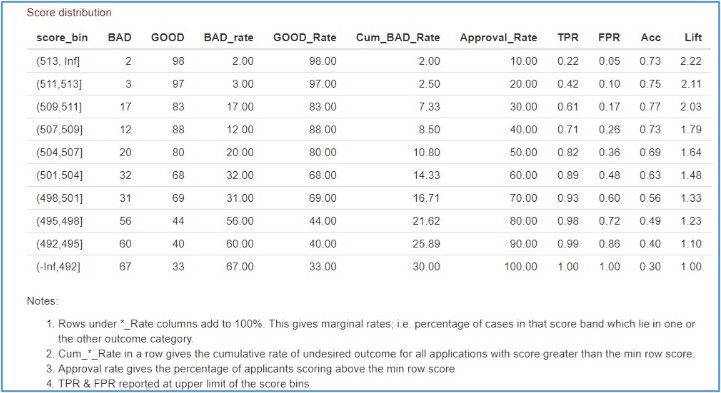

Generation of scorecards in real time with performance measures

Variable transformations are automatically accounted in scoring population

Deployment of the model and scorecard for scoring new applicants.

Easy monitoring of score with the help of interactive reports