Solution

Model developed by R program

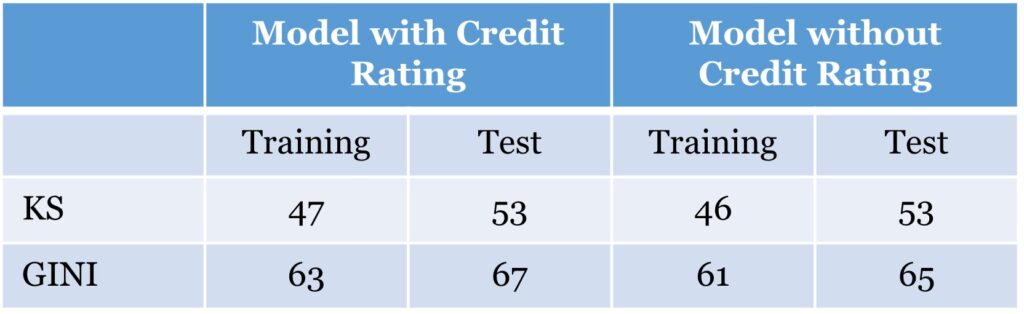

2 scorecards with and without credit bureau ratings were delivered

Discriminatory power of the scorecards were high as seen from high KS and GINI

Benefits

Scorecard developed by Statistical method

Scrutiny restricted to high scorers reducing manual work by a factor of 5 -10