Solution

Data collation to align all variables from same time-period was carried out using R for analysis

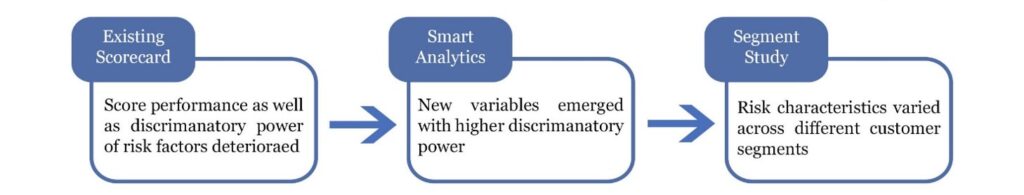

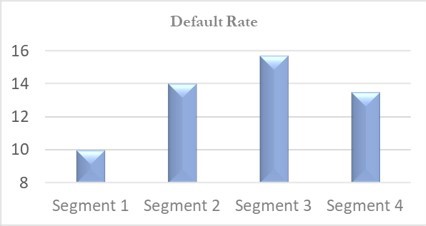

Customers classification using domain knowledge and statistical methods – Decision tree and cluster analysis.

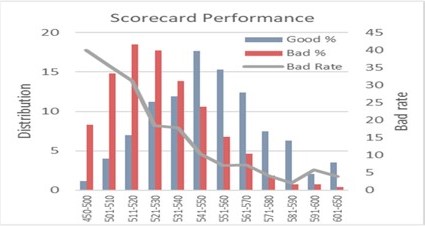

Multiple scorecards each with superior performance than existing scorecard

All scorecards rescaled to have similar odds

Scorecard as a linear function for easy integration with loan origination system

Reviewed underwriting rule and corporate reporting system and recommended changes