CREDIT SCORE

- Credit score is a number representing the creditworthiness of an individual.

- Credit bureaus collect credit information of borrowing and repayment and sell it to creditors for a fee.

- Credit score is primarily based on information sourced from a credit bureau.

- There is no international credit score. Lenders assesses credit worthiness specific to different country and region.

SCORING COMPONENTS – FINANCIAL AND DEMOGRAPHICS

- Number of accounts Active / Inactive / Current / Default

- Length of credit history

- Credit mixMortgage, auto loan, credit card, personal loan

- Repayment history

- Age

- Occupation Self employed / Full time / Half time / Unemployed / Retired

- Years of employment

- Income

- Residential status Rent / Ownership

SCORECARD DEVELOPMENT METHODS

- Expert scorecard Human subject matter expert

- Classical methods Generalized Linear Model (GLM)

- ML models Random Forest, Boosting

- Deep learning Neural network for classification

CASE STUDY 1

- A company in the UK wanted a scorecard for its customers applying for auto loan.

- The profile of the customers was sub prime.

- The vehicles were primarily used ones.

- The lender wanted to improve alignment between underwriter rules and the score.

- They also wanted to compare two different bureau data in terms of quality and coverage.

Solution

- Customer classification using domain knowledge and statistical methods like decision tree and cluster analysis.

- Multiple scorecards each rescaled to have similar odds

- Scorecard as a linear function for easy integration with loan origination system

- Revision of underwriting rule and corporate reporting system to de-duplicate variables across model & underwriting rule engine

Objective

- Application scorecard for auto loans for subprime customers

Benefits

- Multiple scorecards

- superior to a single scorecard

- Recommendation on underwriting

- ensured the exclusion of model variables from underwriting rule

- Consistent decision

- from adaptation of a mathematical model

CASE STUDY 2

- A major Telecom company in Malaysia wanted to create a score for its customers.

- The company was using a bureau score which, was developed by using a database of 1 million customers.

- Telco default was disconnected/suspended 6 months ever.

- A tailor-made scorecard for Telco customers was thought to have better discriminatory power.

Solution

- Characteristics selected from broad areas of auto finance, credit card, personal loan, months in arrears, check bounce, application/approval amount, etc.

- Developed scorecards using:

- Logistic Regression (LR)

- Machine Learning (ML) methods

- Random Forest (RF)

- Extreme Gradient Boosting (XGB)

- Interpretation of ML models were made possible by the use of Local Interpretable Model-Agnostic Explanation (LIME).

Objective

- A telco scorecard to replace bureau scores

Benefits

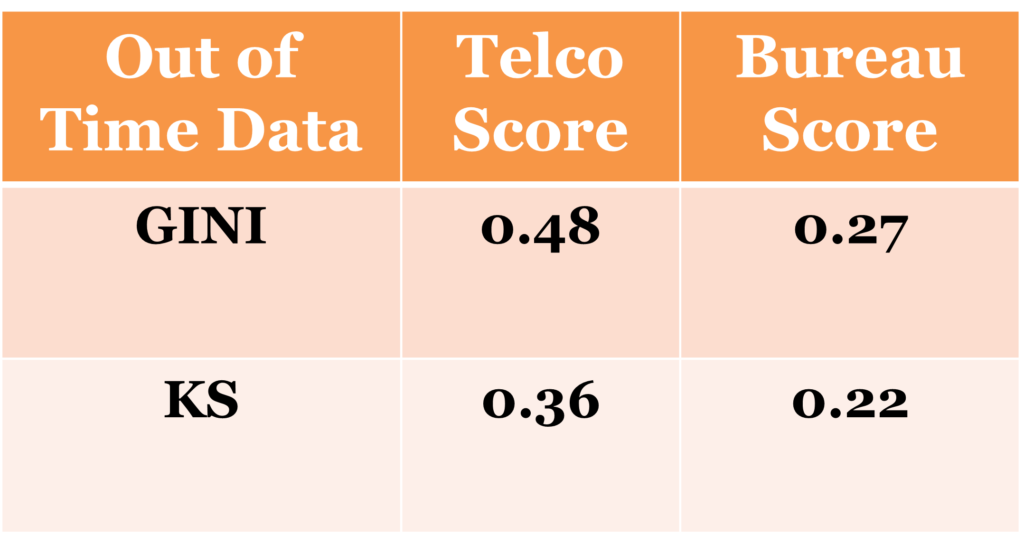

- Logistic and ML models were developed of which XGB performance was superior

- Outperformed bureau score

CASE STUDY 3

- A company in Malaysia wanted to create a customized score for small-ticket loans.

- The company used the bureau score which was developed using Logistic regression.

- It was felt that a generic bureau score was not discriminating enough for this segment.

- A tailor-made scorecard and ML model for evaluating credit risk were required.

Solution

- Characteristics selected primarily from the history of credit card and personal finance of which variables from payment and MOB were the most important variables

- Developed scorecards using:

- Logistic Regression (LR)

- Extreme Gradient Boosting (XGB)

- Interpretation of ML models were made possible by the use of Local Interpretable Model-Agnostic Explanation (LIME).

Objective

- A scorecard with bureau data for small-ticket personal loan

Benefits

- Satisfactory LR and ML scores

- both aided in decision-making

- Model worked for mid level loans

- ensuring application of the same scorecard for a different segment

- Reasons for ML scores

- for each customer added transparency to the black box model